Recently, Filipino workers have been very interested in the OKPeso loan app review. So what is OKPeso? Is OKPeso registered with the SEC? Is an OKPeso loan legit?

In the article below, CDNDongKhoi.edu.vn will analyze and evaluate the advantages and disadvantages, as well as provide detailed information about this loan application, so that readers can decide whether to borrow money here or not.

✅ TIPS: Apply to multiple lenders to increase your chances of getting approved.

Top 10 Legit Online Loan in The Philippines – Only ID Card required

Updated 05/2024

(Register Online)

#1.

|

||

#2.

|

||

#3.

|

||

#4.

|

||

#5.

|

||

#6.

|

||

#7.

|

||

#8.

|

||

#9.

|

||

#10.

|

Contents

- 1. Summary of OKPeso Loan App in the Philippines

- 2. What is OKPeso?

- 3. OKPeso Customer Service

- 4. Pros of OKPeso Online Loan

- 5. Cons of the OKPeso App

- 6. OKPeso Loan App Requirements

- 7. OKPeso App Amount and Term

- 8. OKPeso Interest Rate

- 9. Example of OKPeso Loan Calculation

- 10. Guide to Register OKPeso Safe Online Loan App Step-by-step

- 11. OKPeso Loan App Review and Feedback

- 12. Guide to OKPeso Loan Repayment

- 13. Compare the OKPeso Loan App to other Apps

- 14. Did OKPeso make Harassment?

- 15. FAQs – Frequently Asked Questions about the OKPeso Loan App in the Philippines

- 16. In conclusion – Should you Apply to the OKPeso Loan App in the Philippines?

1. Summary of OKPeso Loan App in the Philippines

| ✅ OKPeso Loan App | ⭐ Review |

| ✅ Maximum amount | ⭐ ₱2,000 – ₱20,000 |

| ✅ Term | ⭐ 96 – 365 days |

| ✅ Age | ⭐ 18 – 49 years old |

| ✅ Interest rate | ⭐ 24%/year |

| ✅ Pros | ⭐ SEC registered loan app |

| ✅ Area support | ⭐ Nationwide Philippines |

| ✅ Guide to | ⭐ Register to OKPeso App |

| ✅ Conditions | ⭐ Only ID Card |

| ✅ Procedure | ⭐ Log in |

| ✅ Bad credit support | ⭐ No |

| ✅ Harassment? | ⭐ Incorrect information |

| ✅ Level of efficiency rating | ⭐ Good |

| ✅ APK | ⭐ App download here |

2. What is OKPeso?

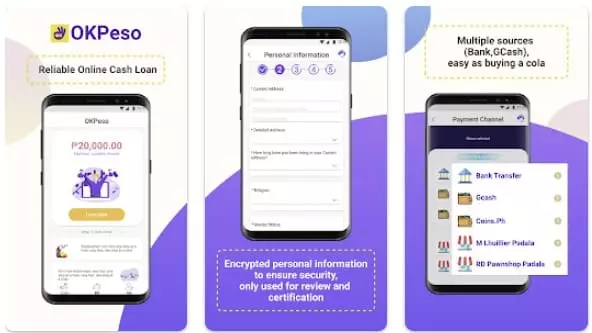

OKPeso is a fast and easy online loan application without collateral. Borrowers only need to download the application to their mobile phones and register to be able to borrow money without leaving home. Lending companies only need to rely on the borrower’s ID card and some financial information to assess the lending ability. The loan amount is up to a maximum of 20,000 pesos and the loan term is from 96 days to 365 days.

The owner of this application is Codeblock Lending Inc., a reputable financial institution registered with the SEC (The Securities and Exchange Commission).

3. OKPeso Customer Service

You may contact Codeblock Lending Inc. for any OKPeso complaints using the following information:

- Office address: 11th Avenue Corner 39th Street Bonifacio Trianglethe Fort Global City, Metro Manila, Philippines.

- Company website: okpeso.com

- Email address: service@okpeso.com

- Contact number (hotline): +63 931 953 3595

4. Pros of OKPeso Online Loan

After reviewing the OKPeso loan app, we found that this application has many advantages over other loan methods, such as:

- There is no need to mortgage assets to the financial institution. Lenders only rely on the borrower’s reputation for evaluation and approval.

- The procedure is simple, just need a National ID Card to apply for a loan.

- There is no need to meet the lender in person, all procedures just need to be done at home via mobile phone or laptop with an internet connection.

- The information is public and transparent on the company’s website. Terms of the loan amount, tenor, interest rate, fees… are clearly stated in the contract.

- Approval time is quick, borrowers receive disbursement within 2 to 24 hours after approval.

5. Cons of the OKPeso App

OKPeso app borrowers should also note some disadvantages when considering choosing this company, such as:

- The loan limit is not as high as borrowing money at a traditional bank.

- Borrowers will pay higher interest rates when borrowing from banks.

- Some additional service fees arise.

6. OKPeso Loan App Requirements

To borrow money at the OKPeso loan app, you only need to meet the following conditions:

- Be a Filipino citizen, and have a valid ID Card according to regulations.

- Age between 18 and 49 years old.

- Have a registered mobile phone number.

- Have a stable monthly income.

OKPeso first loan

Customers borrowing from the OKPeso app for the first time only need to download the app and provide personal information on the app. Then upload the ID Card image and select the loan amount and loan term according to your needs.

OKPeso next loan

To register for a second loan, the borrower only needs to log in to the OKPeso loan app with the registered phone number, select the loan limit, loan term, and request approval.

7. OKPeso App Amount and Term

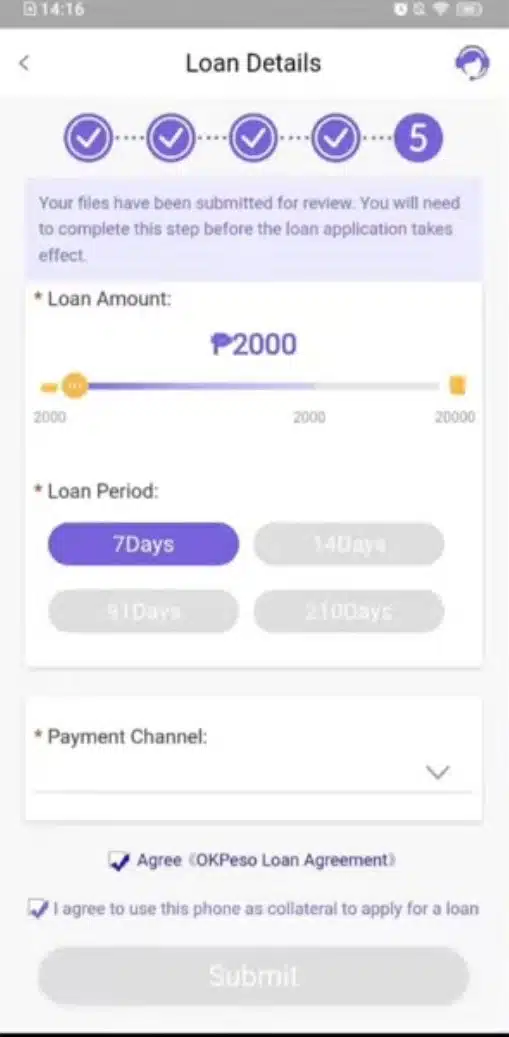

OKPeso review allows borrowers to apply for a minimum of 2,000 pesos and a maximum of 20,000 pesos. In general, this is not a high limit, but quite reasonable and sufficient for consumer needs.

The better the customer’s payment history, the higher the likelihood of being approved for a large loan amount.

OKPeso loan customers can borrow the shortest term of 96 days, and the longest loan term of 365 days (~1 year). This loan term is quite reasonable and gentle, making it easy for borrowers to arrange repayment sources for a long time.

8. OKPeso Interest Rate

Through the OKPeso app review, we found that the interest rates here are quite reasonable compared to the average in the market today, only about 24%/year, i.e. 0.065%/day.

9. Example of OKPeso Loan Calculation

To make it easier for you to imagine, if a borrower applies for an OKPeso loan app worth 18,000 pesos for 6 months, then:

- The principal amount to be paid monthly = 18,000 / 6 = 3,000 pesos.

- Amount of interest payable monthly = 18,000 x 24% / 6 = 720 pesos.

- Total monthly principal and interest = 3,000 + 720 = 3,720 pesos.

10. Guide to Register OKPeso Safe Online Loan App Step-by-step

To register for an OKPeso loan, customers only need to follow the following steps in turn:

Step #1: Download OKPeso loan app

Customers use mobile phones to access the App Store (IOS) or Play Store (Android) to download and install the OKPeso loan app.

Step #2: Register an account

Customers enter their personal phone numbers and press «Send code» to receive an SMS code. After entering the SMS code and selecting «Continue», the customer will successfully register for an account.

Step #3: Fill in personal information

In the next screens, the borrower provides personal information such as:

- First and last name.

- Gender.

- Date of birth.

- Address.

- Religion.

- Marital status.

- Current job.

- Monthly income.

- Monthly costs.

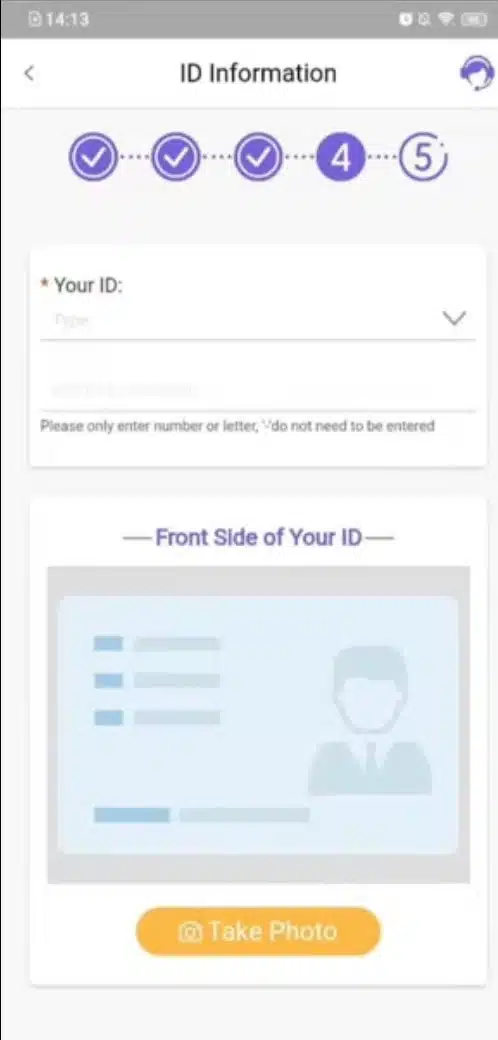

Step #4: Provide ID Card image

Customers choose the ID Card type, fill in the ID Card number, and upload 2-sided images of the ID Card to the application.

Step #5: Choose a loan

In the final step, the borrower just needs to choose the loan amount, loan term, and payment channel and click «Submit» to submit the loan application.

If there are any unclear steps, you can refer to the instructions in the following video:

11. OKPeso Loan App Review and Feedback

OKPeso loan app is a trusted online loan app in the Philippines, SEC licensed, fast transaction processing, and suitable for Filipino workers.

Many customers have been satisfied with the service of this application, the following pictures show it:

12. Guide to OKPeso Loan Repayment

Customers can pay OKPeso loans in one of the following ways:

- Payment via bank: Customers can transfer money to the company’s account according to the information provided in the application.

- Pay at M Lhuillier: Borrowers go to an M Lhuillier location, fill out the form, and pay.

- Pay at 7-Eleven: Go to a 7-Eleven store and make payment at the CLiQQ machine or CLiQQ app.

- Pay at ECPAY: Go to the ECPAY location, fill in the necessary information in the form, pay and receive a receipt.

- Pay via GCash, Coins: Access the application and select Pay Bills, then enter loan information to pay.

Customers can make partially payment for their loans. Additionally, for late payment loans, customers must pay a small fee of 500 pesos.

13. Compare the OKPeso Loan App to other Apps

We have surveyed and compared the OKPeso review with some other loan applications according to our criteria, which readers can refer to.

| Criteria | OKPeso loan app | Finbro | Pesoredee |

| Credit limit | 2,000 – 20,000 pesos | 1,000 – 50,000 pesos | 1,000 – 20,000 pesos |

| Term | 96 – 365 days | 1 – 12 months | 90 – 720 days |

| Age | 18 – 49 years old | 20 – 70 years old | 22 – 70 years old |

| Interest rate | 24%/year | 2,5% – 4,6%/month | Up to 11,9%/month |

| Bad credit support | No | Yes | No |

| Approval time | 15 minutes | 15 minutes | 20 minutes |

| Approval rate | 80% | 80% | 85% |

| General assessment | Good | Good | Good |

Source: According to the survey of the State Bank.

14. Did OKPeso make Harassment?

Some customers of OKPeso report that they are harassed for not paying their debts on time. This is true, but we should look at the problem from both sides.

If the borrower pays late, the company is forced to use the necessary measures to recover the debt. These measures can affect customers’ privacy, disrupting their lives.

However, if the customer reads the contract carefully, it can be seen that the implementation of these debt collection measures is clearly stated in the contract, so OKPeso has a basis to carry out its actions. On the contrary, if the customer pays in full and on time, harassment cannot occur.

Read more:

15. FAQs – Frequently Asked Questions about the OKPeso Loan App in the Philippines

Many readers have questions about the OKPeso loan app, so we have compiled and answered the questions below for readers’ reference:

# Is OKPeso SEC registered?

OKPeso is an application owned by Codeblock Lending Inc. This financial company has registered the OKPeso app with The Securities and Exchange Commission of The Philippines (SEC). Company Registration is NO.CS201913681 and the Certificate Of Authority is NO.3059. You can find that information at sec.gov.ph

# Is OKPeso loan app legit or not?

OKPeso loan app is a legal online loan application and has been licensed to operate by the SEC. All activities of OKPeso must comply with the laws of the Philippines. Interest rates, fees, personal information security, and other contents must comply with State regulations.

# How to pay OKPeso using GCash?

The customer opens the GCash application, selects “Pay Bills” and enters the loan contract number. Then check the loan information again and complete the payment. The fee for payment via GCash is 50 pesos.

# How to delete OKPeso account?

First, you need to contact OKPeso’s support team to notify them of your request to delete your account. You then pay the entire remaining debt balance and send an official account deletion request to the borrower. Once completed, you should request a written confirmation of deletion of the loan account from the company.

# Is OKPeso safe?

Yes. Any online lending application that wants to operate in the Philippines must be reviewed and approved by the SEC, and OKPeso has been granted a license by the SEC. So you can safely borrow money from this application.

16. In conclusion – Should you Apply to the OKPeso Loan App in the Philippines?

OKPeso loan app is one of the reliable options for Filipinos when needing consumer loans, as loans of up to 20,000 pesos can be met in just 2 to 24 hours.

With the above article, we hope to have brought readers useful information, helping readers make accurate loan decisions. If you have any questions, you can leave a comment below for us to answer.

I just got a loan of 15,000 pesos on OKPeso loan app to pay for my house. Thank you for reviewing!

Thank you for sharing!

Thank you because in just 15 minutes I borrowed 10,000 pesos on OKPeso.

Thanks. You are welcome!

Good loan. I recommend